Together with

Greetings Bitcoiner,

Welcome to Issue #370 of Bitcoin Breakdown, where we’re bringing you your end-of-week Bitcoin Digest featuring all the need-to-know Quick Bits snippets and Quick Media.

You currently have {{rp_num_referrals}} referrals. Refer a friend and you both get 4,000 sats (currently worth $4.81) sent directly to both of you!

Here’s your unique link to share: {{rp_refer_url}}&utm_source=BTC{{rp_referral_code}}

But first, today’s Top Stories:

🥱 JPMorgan Finally Wakes Up To Acknowledge the 'Debasement Trade' Trend

🇪🇸 Spanish Banking Giant Goes Full Bitcoin with 24/7 Trading

🤡 NY Goes Full Tax Attack on Bitcoin Mining

TOGETHER WITH BITCOIN DISTRICT

Imagine a tropical jurisdiction where Bitcoin is legal tender, you pay near-zero taxes, and your business can thrive outside regulatory chaos.

It exists. That’s Bitcoin District in Próspera 🏝️

Próspera is a freedom-oriented private city, which seems like… the most bitcoin friendly place in the world! We are creating its layer 2.

There are good ways to check it out:

🌴 Invest in a tropical real estate - Orangeville neighborhood

📅 Relax with a cozy group on Roatan’s Bitchill retreat [Nov 18-25]

⚡ Incorporate your company in regulatory haven & low taxes

🤝 Workaway: volunteer & stay for some time

The future isn’t waiting—it’s being built here. We are open for aligned partnerships ✉️ [email protected]

Oct 3, 2025

TODAY’S TOP STORIES

🥱 JPMorgan Finally Wakes Up To Acknowledge the 'Debasement Trade' Trend

JPMorgan analysts have finally caught up with what bitcoiners have been pointing out for years: investors are driving a ‘debasement trade,’ flocking to Bitcoin to hedge against inflation, deficits, government debt worries, geopolitical uncertainty, and shaky fiat currencies. Bitcoin surged past $120K overnight after JPMorgan also hiked its year-end target to $165K, citing its undervaluation versus gold on a volatility-adjusted basis. With ETFs, custody, and institutional adoption rising, Bitcoin’s safe-haven credentials look stronger than ever. CoinDesk

🇪🇸 Spanish Banking Giant Goes Full Bitcoin with 24/7 Trading

Spain's second-largest bank BBVA just launched round-the-clock Bitcoin trading through its mobile app, making it the first major Spanish financial institution to offer continuous digital asset services. With over $900B in assets and nearly 70M clients worldwide, BBVA is rolling out the feature gradually across Spain after regulatory approval. The bank already recommends 3-7% Bitcoin allocation for wealth management clients. Atlas21

🤡 NY Goes Full Tax Attack on Bitcoin Mining

New York Democrats have unveiled Senate Bill 8518, targeting proof-of-work bitcoin miners with steep excise taxes tied to energy use — unless they run fully on renewables. Rates climb to 5 cents per kilowatt-hour for the biggest energy consumers, with revenue funneled into energy affordability programs. Coming just a year after the fossil-fuel mining moratorium expired, the bill is poised to push miners toward friendlier states, underscoring NY’s persistent hostility toward Bitcoin’s economic potential. Bitcoin Magazine

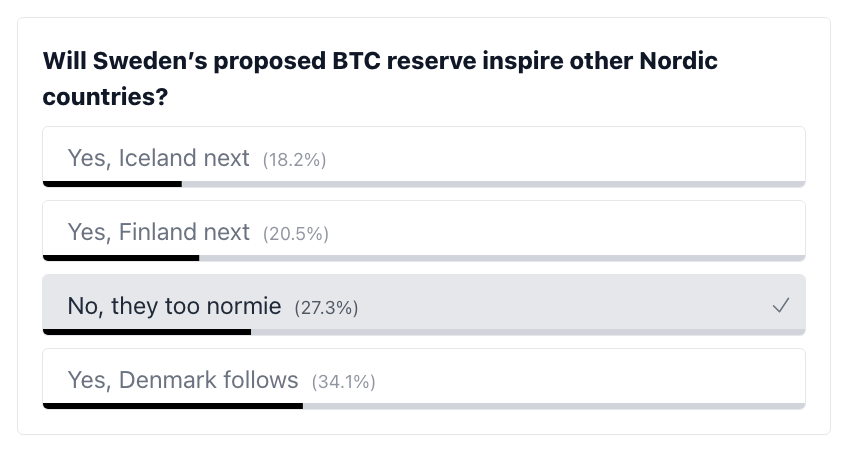

POLL #370

Should states compete to attract Bitcoin miners with zero tax?

PREVIOUS POLL RESULTS

QUICK BITS

Legal experts dismiss Bitcoin Core v30 CSAM liability concerns as overblown, with most arguing existing protections and precedents already address potential risks from larger OP_RETURN transactions.

Ray Dalio expresses skepticism that central banks will consider holding Bitcoin as a reserve currency, citing privacy concerns, but fundamentally misunderstanding its various monetary properties.

Mining difficulty climbed 5% to a record 150.84T on Wednesday, marking the 7th straight upward adjustment as the network's hash rate surged above 1.05 ZH/s.

Lava, a Bitcoin-based lending platform, raises $17.5M from former Visa and Block executives and launches a new dollar yield product offering up to 7.5% APY on bitcoin-backed loans.

ZachXBT, a blockchain sleuth, identifies a $21M theft from Japanese mining company SBI Crypto, with stolen Bitcoin and other cryptocurrencies laundered through the Tornado Cash mixer.

Abu Dhabi Agriculture and Food Safety Authority bans Bitcoin mining on farmland, imposing $27K fines and service suspensions to preserve agricultural sustainability policies.

Canaan Inc, a mining hardware company, sees shares surge 26% after securing the largest Bitcoin mining rig order in 3 years from an undisclosed US buyer.

Metaplanet launches its Phase II perpetual preferred shares plan to fund aggressive BTC accumulation while minimizing common stock dilution for shareholders.

Sygnum, a Swiss bank, launches BTC Alpha Fund targeting 8-10% annual Bitcoin returns through arbitrage strategies while maintaining full price exposure for institutional investors.

MBK, a Japanese company, purchases $2M worth of Bitcoin and partners with exchange FINX JCrypto to offer Bitcoin-powered real estate settlement services.

Bullish exchange launches bitcoin options trading on October 8 with USDC settlement and support from major institutional trading partners including Galaxy Digital and Cumberland.

Mining companies achieve record $50B market cap in September as major firms pivot from Bitcoin mining to high-powered computing for AI sector growth.

Alaska Representative Nick Begich advocates for adding 1M BTC to US reserves through the BITCOIN Act, gaining support from Strategy's Michael Saylor despite criticism over potential conflicts of interest.

Bitcoin Depot, a leading US-based Bitcoin ATM operator, acquires National Bitcoin ATM's 527 kiosks across 27 states, expanding its nationwide footprint and increasing its US market share to approximately 30%.

REFERRAL PROGRAMME TOGETHER W/ OSHI*

REFER A FRIEND,

STACK 4000 SATS EACH, FOR FREE

When your buddy actually reads, you both get paid.

Share your unique link: {{rp_refer_url}}&utm_source=BTC{{rp_referral_code}} (need to be subscribed and logged in to see your unique link)

New subscriber joins and optimally engages by opening ≥ 50% of issues received and making 2 unique link clicks within 15 days.

Boom: 4000 sats to you and them. We’ll automatically email both of you the moment it lands.

*T&Cs: One real human ↔ one inbox. Duplicate or bot sign ups = nuke & lose sats. Fraud flags void payouts. We may adjust rewards if a God candle melts charts. Max 50 referrals per individual. Questions? Hit [email protected]. Ready? Copy, paste, orange pill, stack sats. 🚀

QUICK MEDIA

Mark Moss of Market Disruptors explores the possibility that the US is using crypto and stablecoins to devalue its $37T debt by activating sterilized bank reserves under the Genius Act, prompting central banks to buy gold while investors favor hard assets like gold and Bitcoin (Oct 2 | 15:13 min watch).

Jack Mallers, CEO of Strike, argues that the real 'flippening' is Bitcoin, as neutral money, outcompeting Treasuries in monetary competition and enabling better storage and savings of time, energy and labor, rather than other flippening narratives related to sh!tcoins (Oct 1 | 2:06 min watch).

Matthew Kratter of Bitcoin University argues that Bitcoin Core developers need better understanding of game theory and second-order thinking, as their well-intentioned changes can have unintended consequences that undermine Bitcoin's incentive structures and social contract (Oct 2 | 5:35 min watch).

Forrest Hodl of the Bitcoin Not Crypto channel explains how to consolidate UTXOs (unspent transaction outputs) using Sparrow Wallet to reduce future transaction fees, while highlighting important privacy trade-offs and providing step-by-step consolidation instructions (Sep 30 | 15:11 min watch).

Quoth the Raven of QTR Research, in an interview with Rob Wallace of Bitcoin News, argues that growing public awareness of monetary policy through Bitcoin education creates an unprecedented crisis of confidence that could trigger the long-anticipated sovereign debt collapse when the next deleveraging occurs (Oct 2 | 9:18 min watch).

Southern Bitcoiner, a South African Bitcoin YouTuber, in a newly published tutorial, demonstrates how to securely back up Bitcoin seed phrases using the Cryptosteel Seed12 metal storage system, covering setup, verification, and sealing with tamper-evident protection (Oct 3 | 23:12 min watch).

MEME OF THE DAY

Bitcoin Breakdown has the highest signal-to-noise ratio in its class. If you find our work useful and want to see the publication grow, consider supporting us on Geyser.

Every contribution is a sign that we’re on the right track. We know your time is valuable, and we’re here to help you make the most of it. Thank you for your support.

Thank you for reading!

If you received it from a friend and would like to subscribe, you can do so here:

Until our next transmission,

P.S. Looking to start your own newsletter? Use this link to sign up for beehiiv and get a 30-day free trial plus a 20% discount.