Together with

Greetings Bitcoiner,

Welcome to Issue #451 of Bitcoin Breakdown, where we’re bringing you your end-of-week Bitcoin Digest featuring all the need-to-know Quick Bits snippets and Quick Media.

Now for today’s Top Stories:

🌪️ Kansas Proposes Strategic Bitcoin Reserve

🥊 Thailand Kicks Off 2026 with Bitcoin ETFs

🛡️ Bitwise Launches ETF to Fight Fiat Debasement

TOGETHER WITH ADOPTING BITCOIN CAPE TOWN

Adopting Bitcoin Cape Town is South Africa’s only boots-on-the-ground Bitcoin conference built for grassroots adoption — not “crypto”, not hype.

Happening 30–31 January at Workshop17 (Watershed), V&A Waterfront in Cape Town, this is the 3rd annual gathering focused on what actually matters: real people using Bitcoin to solve real problems, and the parallel systems quietly forming as legacy institutions keep failing the public.

Local tickets are only ZAR1,500 — and they’re moving.

Jan 23, 2026

TODAY’S TOP STORIES

🌪️ Kansas Proposes Strategic Bitcoin Reserve

Kansas is joining the race to adopt sound money with a new bill establishing a state-managed Bitcoin reserve. The legislation proposes transferring unclaimed digital assets to the state after three years of inactivity, holding them in their native form rather than liquidating them immediately. Crucially, the bill prohibits depositing BTC into the general fund, ensuring it remains a long-term reserve asset. The treasurer could even stake assets for yield, proving Kansas is ready to modernize its public finance strategy. Watcher Guru

🥊 Thailand Kicks Off 2026 with Bitcoin ETFs

Thailand is cementing its status as a premier Asian Bitcoin hub by finalizing comprehensive rules for Bitcoin exchange-traded funds and futures. The Securities and Exchange Commission confirmed the 2026 framework allows broader access to digital assets while solving custody issues. Investors can soon allocate up to five percent of their portfolios to Bitcoin or crypto without holding keys directly. With capital gains taxes eliminated until 2029, the Land of Smiles is definitely smiling on Bitcoin adoption. Bitcoin Magazine

🛡️ Bitwise Launches ETF to Fight Fiat Debasement

Bitwise and Proficio Capital Partners are launching a new exchange-traded fund designed to protect investors from the crumbling value of government currencies. The Bitwise Proficio Currency Debasement ETF mixes gold, silver, and Bitcoin to offer a shield against rising national debt. By focusing on these 'hard currencies' rather than traditional stocks or bonds, the fund aims to capture value independent of the US dollar. This move signals a massive secular shift toward assets that governments cannot print into oblivion. Reuters

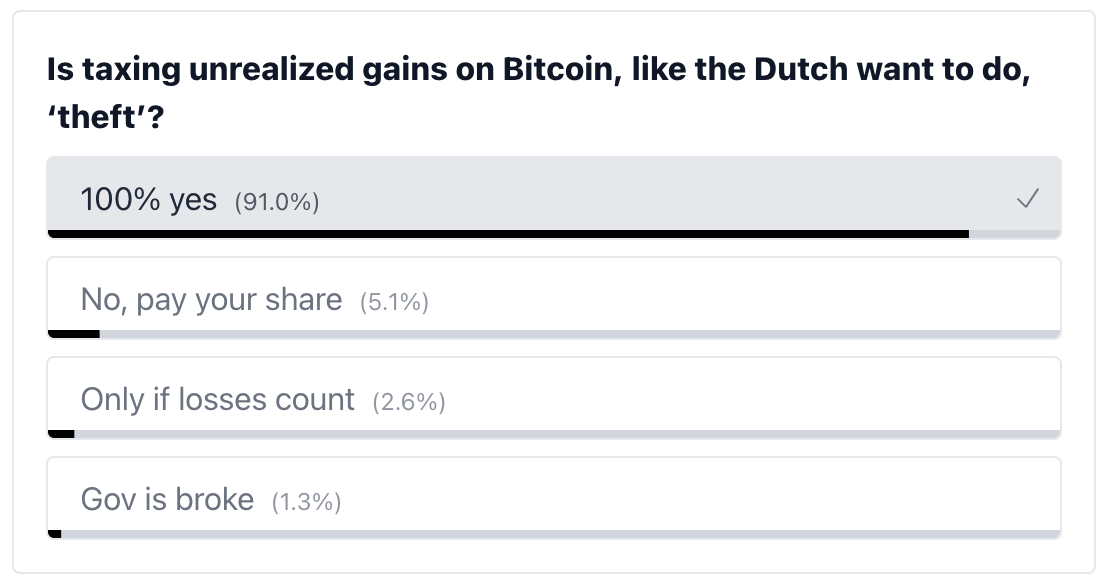

POLL #451

Bitwise Currency Debasement ETF — most likely stress test that breaks it?

PREVIOUS POLL RESULTS

QUICK BITS

Jack Mallers, XXI Capital CEO, drops the BTC-per-share metric and criticizes Michael Saylor’s Strategy for shareholder dilution amid treasury trade pressure.

Ratio of Bitcoin-to-gold hits its lowest level since November 2023, but analysts view the discount as a rare asymmetric setup that historically precedes capital rotation back into BTC.

Las Vegas businesses from restaurant chains to juice bars now accept Bitcoin payments with zero processing fees.

Bitcoin social media posts and Google searches decline 32% and trend downward in 2025 despite BTC reaching new all-time highs.

OpenSats secures $116,000 from the Human Rights Foundation to strengthen its operational infrastructure and continue funding freedom tech builders worldwide.

Programming Lightning, an educational initiative for Bitcoin's Lightning Network, also secures Human Rights Foundation funding to launch a hands-on Replit course teaching students to build payment channels and pass BOLT 3 test vectors in 2026.

ZBD, a Bitcoin payments, raises $40M in Series C funding led by Blockstream Capital to expand payment infrastructure and BTC rewards for video games.

South Korea investigates the loss of $48M in confiscated BTC after wallet passwords were exposed during routine checks, enabling phishing attackers to drain funds stored on USB drives.

Fedi partners with Cornell University and Bitcoin Policy Institute to conduct a two-year study examining American attitudes toward financial privacy and regulatory impacts on developers.

PricewaterhouseCoopers reports that Bitcoin and crypto adoption varies widely by region due to differing economic conditions, while institutional interest has become irreversible despite concerns about future price momentum.

Coinbase assembles expert panel to address quantum computing threats to Bitcoin and blockchain security, as industry debates timeline and severity of cryptographic vulnerabilities.

ARK Invest, Cathie Wood's investment firm, forecasts Bitcoin's market cap will surge 700% to $16T by 2030, implying an $800,000 BTC price.

QUICK MEDIA

Jack Mallers, CEO of Strike, argues that Bitcoin and Nasdaq have diverged because US markets have become politically manipulated to favor AI investments, while Bitcoin continues its fundamental role of reflecting true fiat liquidity and safeguarding property rights (Jan 21 | 1:31 min watch).

Hurley of Swan Bitcoin argues that bitcoin’s 2026 drawdown versus gold’s push toward $5,000 fuels hedge doubts, but Davos backlash, Cathie Wood’s cycle view, and volatility compression signal a long consolidation that could precede a major macro-driven breakout (Jan 23 | 16:20 min watch).

Robbie P, a rapper who makes Bitcoin-related music, warns that a person going by the name 'Kenneth Lee' is attempting a social engineering impersonation scam posing as a CoinDesk employee, urging heightened vigilance against scams, identity fraud, and phishing attacks like these targeting Bitcoiners (Jan 21 | 1:22 min watch).

Matthew Kratter of Bitcoin University argues that Bitcoin Core maintainer Gloria Zhao’s recent 𝕏 account hack and her claim she is not a full-time developer expose weak security and governance, fueling calls to run Bitcoin Knots as Core loses trust and share (Jan 21 | 7:48 min watch).

Parker Lewis, author of 'Gradually, Then Suddenly', in an interview with Preston Pysh, argues that Bitcoin represents the world's greatest asymmetric opportunity while fiat currency erodes not only purchasing power but overall standard of living, urging people to focus their energy on Bitcoin (Jan 22 | 2:06 min watch).

Mark Moss of Market Disruptors argues that US sanctions and tariffs accelerate a structural shift in global financial infrastructure as countries reroute trade away from dollar rails, lean on mBridge-style settlement, and use gold plus Bitcoin and BTC as neutral collateral beyond US Treasuries (Jan 21 | 25:50 min watch).

MEME OF THE DAY

Bitcoin Breakdown has the highest signal-to-noise ratio in its class. If you find our work useful and want to see the publication grow, consider supporting us on Geyser.

Every contribution is a sign that we’re on the right track. We know your time is valuable, and we’re here to help you make the most of it. Thank you for your support.

Thank you for reading!

If you received it from a friend and would like to subscribe, you can do so here:

Until our next transmission,

P.S. Looking to start your own newsletter? Use this link to sign up for beehiiv and get a 30-day free trial plus a 20% discount.