Together with

Greetings Bitcoiner,

Welcome to Issue #459 of Bitcoin Breakdown, where we’re bringing you your end-of-week Bitcoin Digest featuring all the need-to-know Quick Bits snippets and Quick Media.

But first, today’s Top Stories:

🧯 Bitcoin Flushes $2.5B in Overleveraged Longs

🤖 AI Agents Get Lightning Wallets, Skip the Banks Entirely

☕ Dimon Tells Coinbase CEO He's 'Full of S---' at Davos

xNostr lets you auto-sync new 𝕏/Instagram content to Nostr on your schedule—so you can grow a censorship-resistant audience without abandoning your current following.

It supports secure signing, auto-posting to Nostr (via NIP-46 remote signing), and Blossom media uploads to keep your images/videos decentralized.

Plans start at only $25/month and you can pay via Bitcoin Lightning.

🧯 Bitcoin Flushes $2.5B in Overleveraged Longs

Bitcoin dipped from $84K to $75K in hours over the weekend, liquidating $2.56B in derivatives and wiping out 420,000 traders. The broader market shed $111B as price sliced through the 50-day EMA and key trendline support.

Why it matters: Forced deleveraging purges leverage tourists while new address creation hit a two-month high, a reminder that volatility shakes out weak hands while conviction stack sats. Translation: everyone begged for cheaper corn, now they're too scared to buy it. Read more→

🤖 AI Agents Get Lightning Wallets, Skip the Banks Entirely

Clawdbot Moltbot OpenClaw took the AI world by storm last week and saw the rise of Moltbook, a social platform where autonomous AI agents post, debate, and organize like Reddit users, but nonstop. Bram Kanstein soon dropped Start With Bitcoin, an open-source toolkit guiding agents to transact via Lightning and Nostr identity, joining Bitcoin Phoenix's earlier Agentstr toolkit for building Bitcoin-native decentralized agentic applications.

Why it matters: Autonomous software needs trust-minimized money, and Lightning's instant, permissionless settlement is the obvious fit. No 'grandma pitch' required, AI agents already grasp sound money incentives and settle on Bitcoin by default. From here, things escalate. Read more→

☕ Dimon Tells Coinbase CEO He's 'Full of S---' at Davos

JPMorgan's Jamie Dimon reportedly jabbed a finger at Coinbase's Brian Armstrong at Davos, cursing him out after Armstrong accused big banks of gutting the Senate's CLARITY Act. The fight centers on stablecoin yield, where exchanges pay rewards that threaten bank deposit monopolies.

Why it matters: Legacy finance shows its hand, lobbying to ban competition rather than innovate. Banks want regulatory moats; stablecoins are the gateway to Bitcoin, which needs no permission. Read more→

After Bitcoin’s $2.56B liquidations, What’s Most Likely This Week?

Metropolitan Capital Bank becomes the first bank of 2026 to collapse amid violent selloffs in gold, silver, and Bitcoin, signalling potential financial system stress as $337B in unrealized bank losses loom over markets.

AMBOSS announces RailsX, a Lightning Network-based peer-to-peer trading platform that enables KYC-free bitcoin and Taproot Asset swaps without intermediaries or centralized exchanges.

Bitcoin’s sharp pullback knocked its market value to roughly 1.65T and slid it to 11th among global assets, just behind Saudi Aramco and Taiwan Semiconductor Manufacturing.

Star Xu, founder and CEO of OKX, attributes bitcoin's October flash crash to Binance's USDe leverage loops, sparking industry debate over the $19B liquidation event's true causes.

Glassnode data reveals that bitcoin 'mega-whales' holding 10,000+ BTC are accumulating during the selloff while retail traders with less than 10 BTC continue selling.

Michael Saylor signals another Bitcoin purchase after BTC drops below the company's $76,040 cost basis.

Tennessee lawmakers advance legislation allowing the state to allocate up to 10% of public funds to Bitcoin reserves.

Daniel Batten, a Bitcoin sustainability researcher, debunks the IMF's claims about Bitcoin’s energy consumption, providing 19 documented cases of Bitcoin using stranded energy.

Bitcoin Beach hosts global summit in El Zonte, sharing proven strategies for building sustainable circular economies with leaders from 29 countries emphasizing concentrated adoption and community empowerment.

Elon Musk's potential SpaceX-Tesla merger would consolidate nearly 20,000 BTC worth $1.7B, creating one of the world's largest corporate bitcoin holdings under single governance.

US Treasury's Office of Foreign Assets Control targets two UK-registered exchanges for processing $94B in Iran-linked transactions, marking first digital asset platform sanctions under Iran program.

Santiment, a Bitcoin and crypto analytics platform, identifies extreme market fear as a bullish signal.

Bitcoin hits record low against gold in January 2026, creating what analysts call a better buying opportunity than 2017's bull market precursor.

Carla and Walker, a Bitcoin content creator couple, in an appearance on the Bitcoin Archive podcast, warn investors that Bitcoin is entering a 'thousand-year super cycle' driven by massive liquidity injections, suggesting those waiting before they buy (more) may regret missing current accumulation opportunities before traditional four-year cycles become irrelevant (Jan 31 | 18:56 min watch).

Jack Mallers, CEO of Strike, argues that while hyperbitcoinization represents the future, Bitcoin currently remains too small to challenge sovereign debt, with gold's recent performance serving as a bullish indicator for Bitcoin amid fiat currency decline (Jan 29 | 1:48 min watch).

John Vervaeke, Philosopher and Cognitive Scientist, in an interview with Robert Breedlove of the 'What Is Money?' Show, explore how private property creates ethical boundaries for competition without coercion, why free markets function as collective intelligence, and how money printing disrupts price signals that guide complex economic systems (Jan 27 | 7:59 min watch).

Joe Nakamoto, a Bitcoin journalist, documents his ambitious 24-hour challenge to use Bitcoin for real-world purchases across multiple European countries, successfully completing transactions in five nations including Finland, Latvia, Austria, Hungary, and Slovakia before missing his final opportunity in Portugal (Jan 31 | 20:33 min watch).

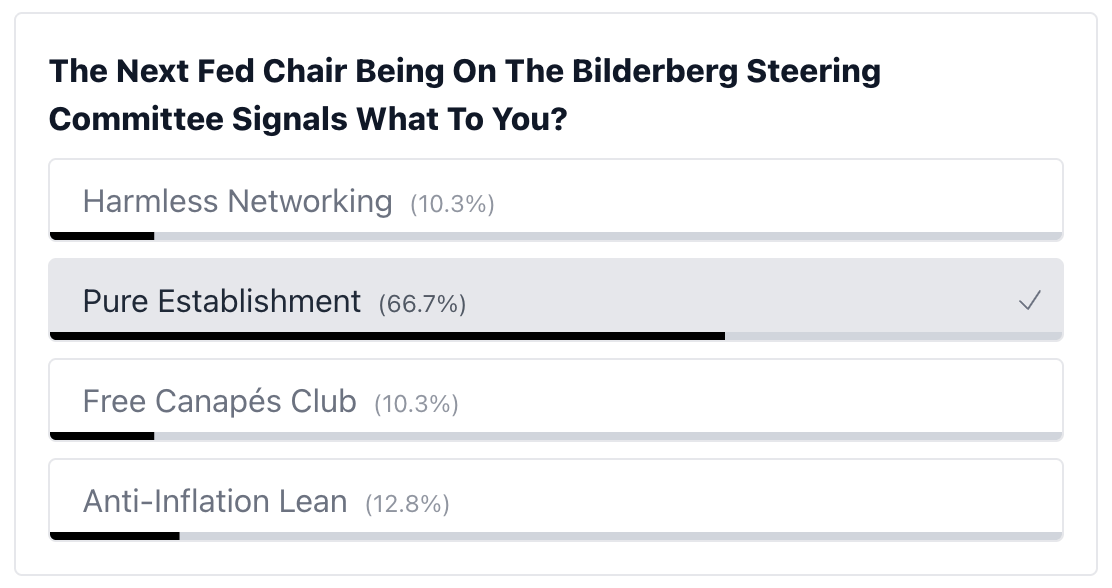

Dante Cook of Simply Bitcoin argues that Bitcoin's 40% crash from its ATH to below $80K reflects a global monetary reset driven by a $1B liquidation, Fed balance sheet concerns under new chair Kevin Warsh, and a power shift from the Fed to the Treasury rather than mere market fear (Feb 2 | 16:35 min watch).

ICYMI: Kevin Warsh, President Trump's pick for the next Federal Reserve Chair, in an appearance on Uncommon Knowledge with Peter Robinson of Hoover Institution, describes bitcoin as an 'important asset' that serves as a 'policeman for policy' and represents innovative software enabling unprecedented financial capabilities for policymakers (Jul 8 2025 | 2:37 min watch).