Greetings {{ name | Earthling }},

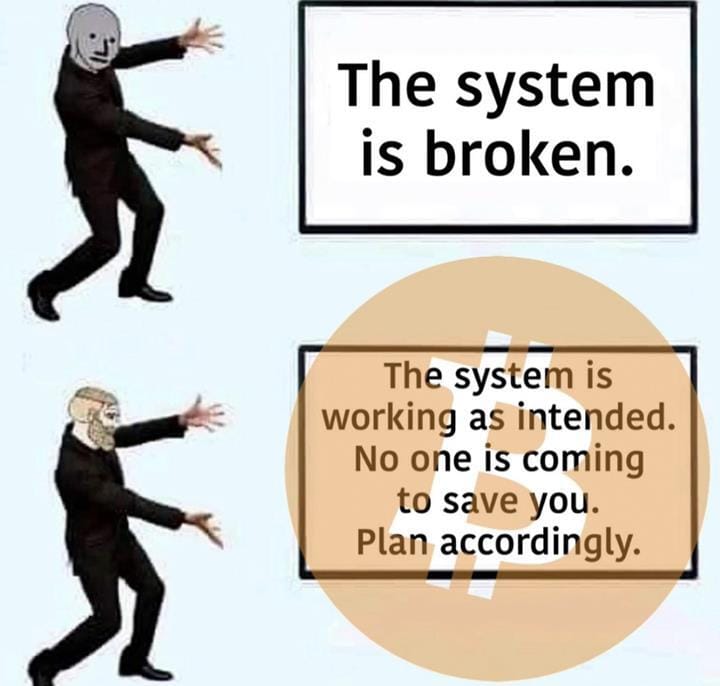

Welcome to issue #30 of the Bitcoin Breakdown, where we fully appreciate that owning Bitcoin is a declaration of monetary independence and personal sovereignty.

First time reading? Sign up here.

Interested in sponsoring the newsletter and reaching thousands of burgeoning and dedicated bitcoiners alike? Please click here.

Please share feedback via the poll near the end of the newsletter if you feel like I can change or amend anything about the newsletter to make it better. Happy reading! 👽️

📰 HEADLINES

Xwitter is one step closer to integrating digital assets into its platform after obtaining a license that lets its store, transfer, and exchange digital assets, as well as hold assets on behalf of its users.

It remains to be seen what specific cryptocurrency services the company will offer, but at least Elon Musk has previously indicated that Xwitter will never launch its own sh!tcoin.

Whether or not they are wise enough to integrate Bitcoin and the Lightning Network, the company is not necessarily the most desirable ally of sovereign individuals. Just this week, Xwitter upended its privacy policy to include a range of deeply personal user data - biometric data, education and job history.

Grayscale wins case against Securities and Exchange Commission, with a US federal court ruling that the SEC acted unfairly in denying Grayscale’s request to turn its Grayscale Bitcoin Trust product into an ETF.

‘The denial of Grayscale’s proposal was arbitrary and capricious because the Commission failed to explain its different treatment of similar products,’ the court said.

The long-awaited decision gave a big boost to prices across the board with BTC’s average trade size jumping to its highest level since June.

Bloomberg analysts raised their ‘predictions’ for an approval of spot Bitcoin ETFs launching this year to 75%.

The SEC subsequently indicated that it will delay responding to ETF applications for another 45 days.

Bitcoin enthusiasts shouldn't despair; you'll still have some more time to accumulate BTC via cost-averaging before the FOMO-driven BTC ETF mania takes off. Let them have their paper BTC.

Kickstart your #SoundFinance Journey with Free Sats

Interested in earning 50K satoshis? You should check out Atomic Finance.

Discreet Log Contracts (DLC) offer a secure way to innovate with Bitcoin while minimizing custody risks. Atomic Finance is among the pioneers utilizing DLC technology, enabling you to earn yield on your BTC holdings without surrendering custody.

If you sign up here you’ll receive an initial bonus of 20K sats when you first invest and a recurring monthly bonus of 10K sats for the first three consecutive months.

🏆 TOP STORIES

How Banks Became Centralized (Free Chapter from Lyn Alden's new Book ‘Broken Money’) (Aug 2023 | 37 min read)

Lyn Alden's brand-new book, 'Broken Money,' is being touted as potentially becoming more influential and formative than Saifedean Ammous' 'The Bitcoin Standard,' which is often referred to as the 'Bitcoin Bible.' It details the past, present, and future of money and monetary technologies and why, despite being softer money than gold, fiat money has replaced the gold standard everywhere in the world. Here is an excerpt from the free chapter: ‘Nature’s ledger (gold) has robust parameters for supply and debasement but doesn’t move and get verified fast enough in the telecommunication age. Mankind’s ledger (the dollar) moves and gets verified fast enough but doesn’t have robust parameters for supply and debasement. The only way to fix this speed gap in the long run would be to develop a way for a widely accepted, scarce, monetary bearer asset itself to also be able to settle over long distances at the speed of light. That’s one of the major reasons why the discovery of digital scarcity and the invention of Bitcoin is so significant.’ You can get the whole book here.

Arthur Hayes’ Latest: Kite or Board (Aug 24 | 36 min read)

In his latest blog post, Arthur Hayes (founder of BitMEX), raises concerns about the ‘TradFi takeover.’ He points out that BlackRock, a financial giant, is not concerned with decentralization and has in fact built a trillion-dollar business by centralizing assets. As the traditional finance system faces challenges, institutions like BlackRock are turning to cryptocurrencies as a hedge against inflation and seek to exert control over the industry. Their goal appears to be establishing themselves as the ‘crypto gatekeepers,’ with the intention of imposing exorbitant fees for buying and selling cryptocurrencies. As always, read 0xjaypeg’s excellent summary of the whole piece here.

Bitcoin: Self-Sovereignty and Liberty in the Digital Age (Aug 30 | 6 min read)

Leon A. Wankum writing for European Bitcoiners calls for a reassessment of the notion of digital property in light of Bitcoin's attributes and its potential to reshape economic landscapes. He explores the concept of property rights, contrasting the traditional view of property as something granted by authorities with the Austrian School of Economics' perspective that property rights are inherent and emerge naturally through human labor and exchanges. Wankum delves into the importance of property in enabling human action and efficient resource use. Bitcoin centres around cryptographic control, creating a paradigm of digital self-sovereignty, independent of authorities or legal systems. This provides a safeguard against the invasion of privacy and ensures the protection of individual freedom.

Why You Stack like a Maniac and They Don't (Aug 25 | 2 min read)

In this thread, Bitcoin Maxi News discusses the motivation behind accumulating Bitcoin despite its price volatility, attributing it to the concept of ‘perceived value.’ Individuals who believe in the long-term value of Bitcoin over fiat currency are more inclined to invest in it heavily. The thread emphasizes the importance of understanding this concept to encourage others to embrace Bitcoin. Acquiring this conviction doesn't necessarily require a lengthy process of unlearning and re-education. It is important to portray Bitcoin's value proposition in a clear and normie-friendly way. All-in-all, it is crucial to appeal to individuals' self-interest before attempting to change their worldview.

Cointime Economics: A New Framework for Bitcoin On-chain Analysis (Aug 23 | 70 min read)

David Puell from ARK Invest and James Check from Glassnode created a Bitcoin research framework that suggests the bear market is worse than currently understood. Traditional methods employed by investors involve calculating the average 'buy price' of all Bitcoin transactions ever executed. If this average is lower than the current BTC market price, it signals a healthy market, whereas a higher average suggests the market is in a less favorable state. However, Puell and Check argue that the conventional approach to determining the market's average buy price is flawed. This approach includes factoring in the buy prices of numerous lost bitcoins, acquired at various low price points such as $1, $10, or $100, which have subsequently become inaccessible due to lost wallet keys or passwords. These bitcoins are effectively removed from circulation, rendering them incapable of influencing the market in any way. Consequently, when these inaccessible bitcoins are excluded from the calculation, the true average buy price for the market stands at $32,000 per BTC. Get the short version of the report here.

Reverse Broadcasting (Aug 28 | 3 min)

Michael Rhee in a blog post for Wavlake discusses how open protocols could revolutionize the way we determine the popularity of music and other content. He highlights the issue of media consolidation where a few companies control both content programming and audience measurement, limiting audience choice and customization. The proposed solution involves using Bitcoin and Nostr to enable transparent and verifiable micropayments from fans to artists. This data would provide a more accurate reflection of content popularity based on active engagement and enthusiasm, rather than passive listening. The goal is to create a system where audiences have a voice in shaping content popularity, ultimately leading to more individualized recommendations and a more open and standardized approach to content distribution and measurement.

NEWSLETTER RECOMMENDATION OF THE WEEK

Sponsored

The Wall Street Rollup

Your new favorite Earnings, Finance News, and M&A Transactions Newsletter Blotter from Anonymous Wall Street Professionals

📖 GUIDES & EXPLAINERS

CoinJoin: What Is It and How It Works (Aug 29 | 16 min read)

Andrea Carnimeo penned this thorough exploration of CoinJoin, a privacy technique used in Bitcoin transactions. CoinJoin works by combining multiple transactions into a single pool, making it difficult for third parties to trace the sources and destinations of funds. Implementations like Samourai Wallet, Wasabi Wallet, and JoinMarket facilitate CoinJoin transactions. It is a valuable tool for protecting privacy when spending Bitcoin, making it harder for recipients to trace the origin of payments. However, it doesn't hide your total Bitcoin holdings from the archons if acquired through KYC exchanges, and using it as a means to claim lost coins in, say, a boating accident requires careful handling. The effectiveness of CoinJoin depends on your specific privacy needs and goals.

Unlocking Ultimate Security: Air-Gapped Bitcoin Transactions with Blockstream Jade (Aug 31 | 52:27 min watch)

BTC Sessions explores the Blockstream Jade hardware wallet in this step-by-step tutorial. Designed for maximum security and user-friendliness, the Jade offers a unique feature: air-gapped operation. This means you can authorize transactions without ever physically connecting the device to a computer or phone, ensuring an extra layer of protection against potential threats. Overall, the Blockstream Jade is a user- and budget-friendly and secure option for Bitcoin transactions. Get 10% off of your Jade here when using the coupon code: bitcoinbreakdown.

💥 MEME BREAK

How did you like this week's newsletter?

Thank you for reading!

If you enjoyed this week’s issue then please forward it to a fellow bitcoiner and/or consider leaving a tip below or here.

If you received it from a friend and would like to subscribe, you can do so here:

If you’re interested in sponsoring the newsletter, then please click here.

Until our next transmission,

Naiw